The geographical area represents the location of the expense. It can be selected by the employee who enters an expense report.

Who is concerned by this article?

The administrator as responsible of Eurécia configuration.

Usefulness of geographical areas

Geographical areas have several uses.

VAT Recovery

When VAT is recovered on some expenses, they are used to define the types of VAT available for entering expenses. For example, if you want to recover VAT on certain expenses made in France but you do not recover it for expenses made in other countries, you will have to create two distinct geographical areas:

- 'France' area contains VAT rates available on the expense receipts: 5.5% 10%, 20% and 2.1%

- 'Other country' area does not contain any VAT rates

Those areas are available in the configuration of expense types (VAT section) in order to define the authorized rates and the % of recovered VAT.

Reimbursement limits

Geographical areas are used when reimbursement limits are defined according to the expenses areas. For example, if the expenses in some cities are limited to 20€, and some expenses in other cities can be limited to 18€, then you need to create two distinct geographical areas:

Those areas are available in the configuration of expense types (payment section) and in the configuration of associated groups (limits section) in order to associate a limit to an area.

A geographical area, a country

A geographical area can be a country but even more that just a country:

- The area can be a country (for example, France)

- The area can be several countries (for example, Europe)

- The area can be a tiny part of a country (for example, a region)

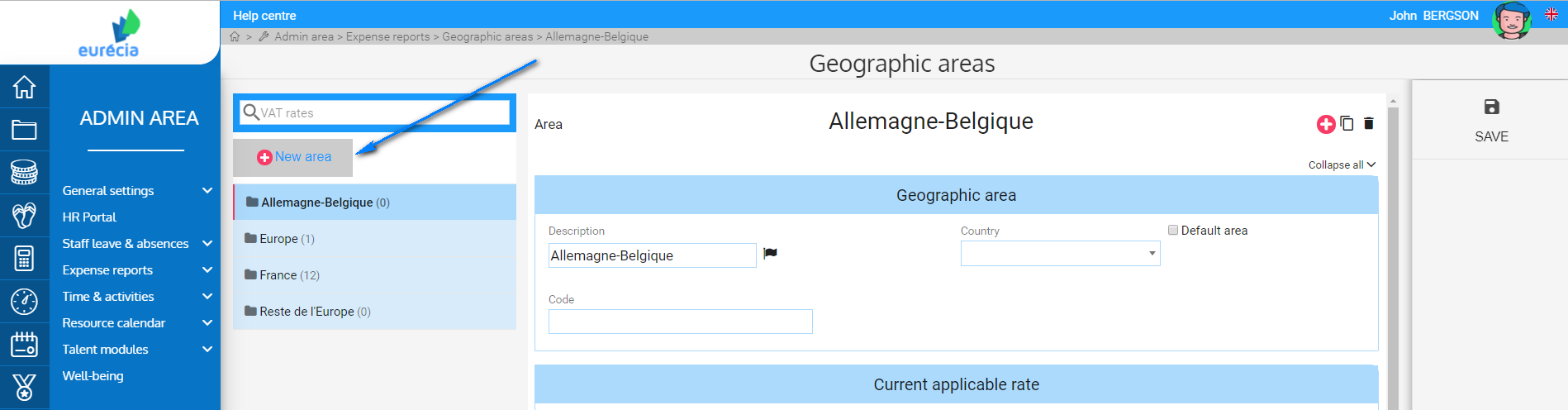

Create a geographical area

Access : Admin Area > Expense reports > Open Geographic areas and VAT

- Click on 'New Area"

- Fill-in a name in 'Description'

- Fill-in a country (if the area is a country or a region, otherwise let it empty)

- Check ' Default area' in order to have the zone in question proposed first when entering an expense

- Save

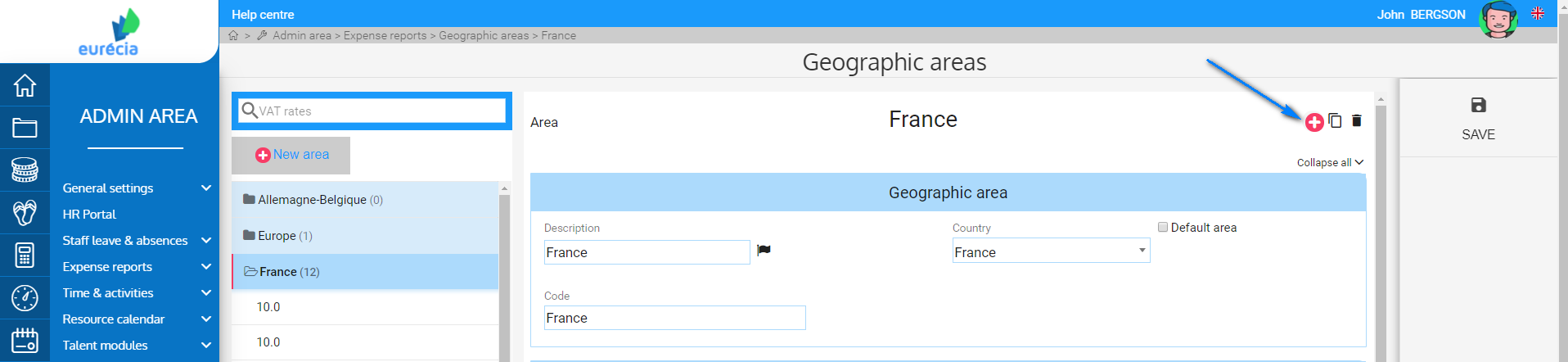

Add VAT rates

Access : Admin Area > Expense reports > Open Geographic areas and VAT

- Click on an existing area

- Click on

to add a VAT rate

to add a VAT rate

- Fill-in the description of the VAT rate

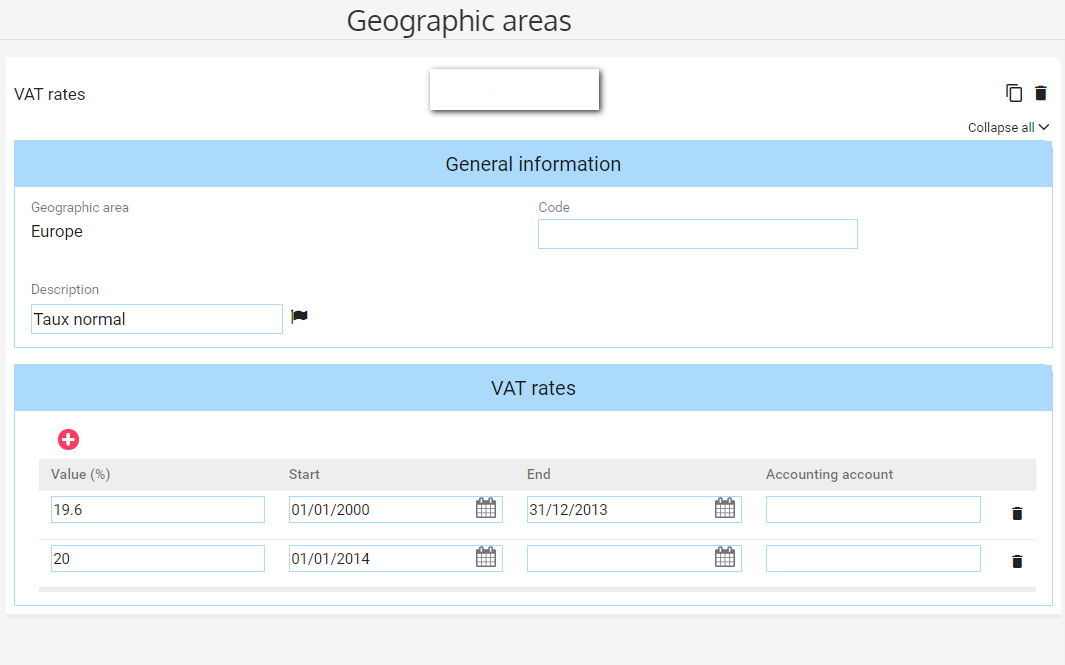

- In 'VAT rates' click on

to add a rate

to add a rate

- Fill-in the actual value of the rate, for example 20 for a 20% rate

- Fill-in Start and End dates: let it empty if you do not know the dates

- Fill-in the Accounting account

- Save

Keywords associated to this article:

Geographical areas - VAT - VAT rates - areas - expense reports - reimbursement - professional expenses - rate value

Comments

0 comments

Article is closed for comments.