If an employee is entitled to meal vouchers and create an expense report and add an expense such as 'Midday meal' two situations are possible:

- Deduct a meal vouchers

- Deduct the amount of the company contribution of the meal voucher

With Eurécia you can configure one or the other situation.

Who is concerned by this article?

The administrator as responsible of Eurécia configuration.

Configure the impact on meal vouchers

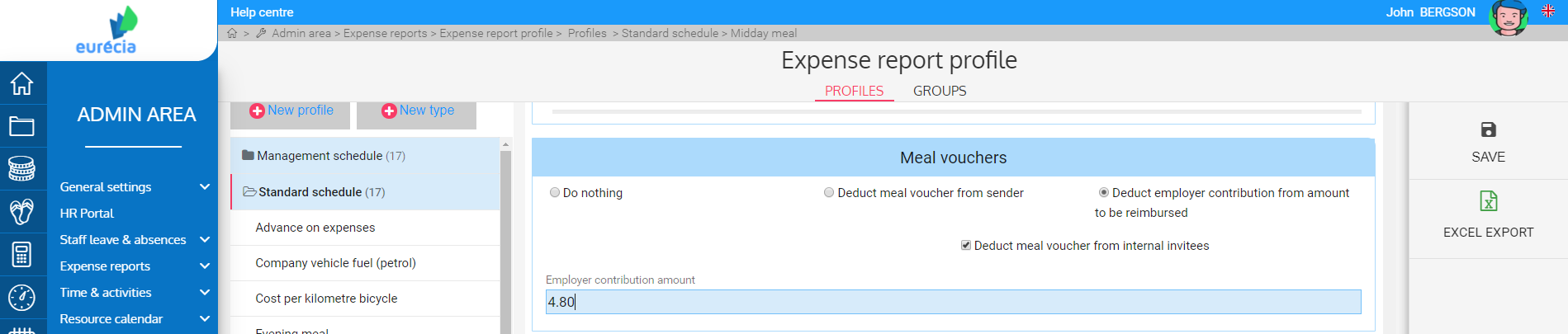

Access: Admin Area > Expense reports > Open Profiles and Groups

- Click on the expense report profile concerned

- Select the expense type that have to deduct a meal voucher or the company contribution (usually that concerns 'Midday meal')

- Go to 'Meal vouchers' and select:

- Do nothing: this expense type won't have any impact on meal vouchers

- Deduct meal voucher from sender

- Deduct employer contribution from amount to be reimbursed

- Check 'Deduct meal voucher from internal invitees' to deduct a meal voucher to invitees

|

In 'Controls input', we recommend to disable 'Authorize this expense type several times a day' because an expense of this type is only selected once a day. The software will deduct only one meal voucher per day maximum. |

- Save

Deduct the company contribution of the total amount of the expense report

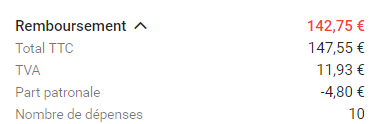

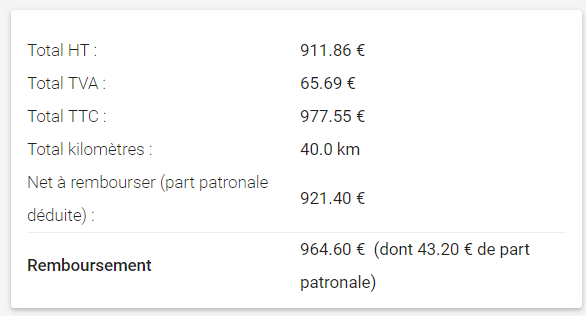

In Expense reports, the total amount of deduction of the company contribution is displayed in the detail of the reimbursement.

The line "Company contribution" then corresponds to the number of expenses deducting the company contribution, multiplied by the amount of the company contribution (in the currency of reimbursement).

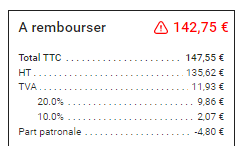

If you print it, this information is available in the total amounts:

Internal invitees and Meal vouchers reports

The company contribution is not deducted of the expense report for internal invitees.

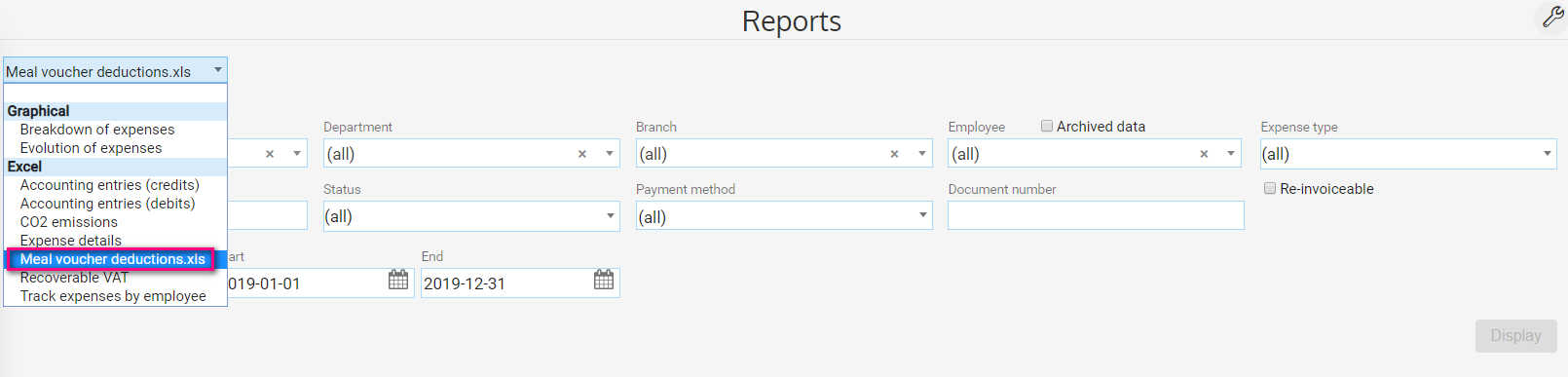

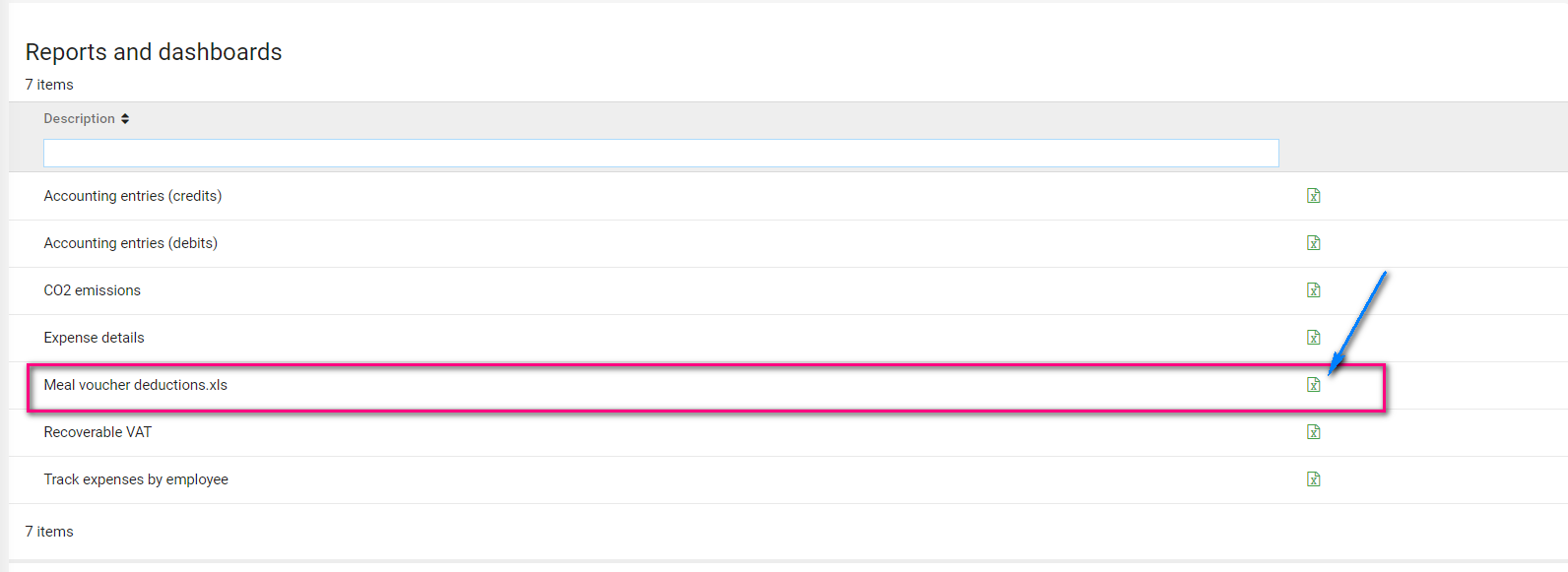

Access : Expense reports > Reports

- Choose 'Meal Vouchers deduction.xls'

- If necessary, filter data to display in the export: by period, department, by employee etc.

- Click on the excel logo to download the file:

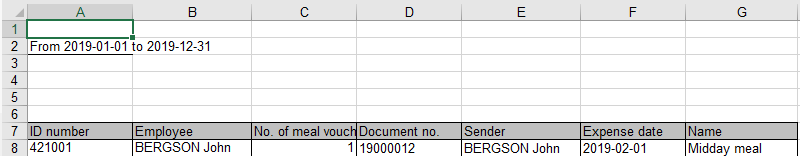

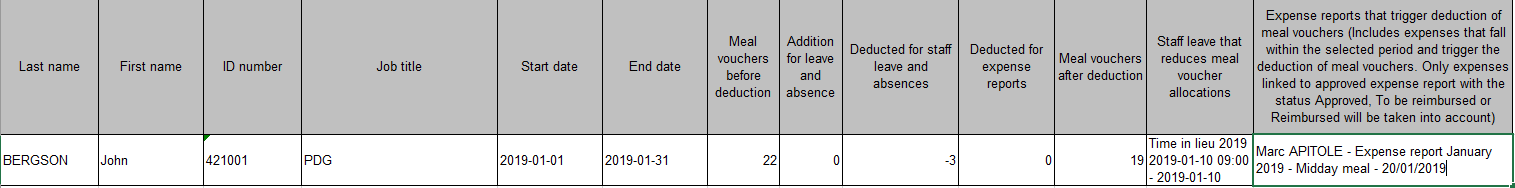

The amount of meal vouchers that need to be deducted on the next order appear in the report, with the detail of each expense report for each employee:

|

|

Access : Remuneration > Meal vouchers

- Click on 'Order'

- Open the Excel file > Details Tab

Company contribution and expense analysis

Access : Expense reports > Expenses analysis/ Accounting export

- In the report of expenses, the amount of the company contribution to deduct is displayed:

What happens if the expense is less than the company contribution?

in this case, the total of the company contribution is deducted and the amount to reimbursed is negative if the expense report does not contain other expenses.

The employee then looses money, there is no interest in declaring that expense.

How is manage the accounting export?

In the case of a multi-vat expense type, a line with the pro-rata amounts excluding VAT and including VAT is generated for each VAT rate.

The company contribution is fully deducted on the first VAT line.

Keywords associated to this article:

Professional expenses - expense reports - internal invitees - company contribution - meal vouchers - sender - reimbursement - meal vouchers reports

Comments

0 comments

Article is closed for comments.